Cambridge Bitcoin Electricity Consumption Index just passed 200 terawatts for the first time...

And Bitcoin crashed over $4,000 so let's run our miner P&L calculation again!

Annual Coin Income: $108k x 165k coins = $17.8 billion

Annual Energy Cost: 204 terawatts @ $0.105 per kwatt = $21.4 billion

Net Loss: $3.6 billion; miners down $4-5 billion in the past 18 months.

Energy use rose an annualized 14% in 2025 so far. I have no positions related to Bitcoin, I believe a systemic failure is more likely than Coiners think but I also have seen them keep pumping Bitcoin so it's too unpredictable for my taste.

Gold/Silver is a much easier calculation. With the current rate of fiat creation plus global uncertainty, $5k per ounce seems likely with a good possibility of a $6-8k panic spike. Gold rose from $35 to $850 (24x) in the previous cycle (1971-1980). Assuming the current cycle began at $280 in 2001, a repeat cycle spikes to $6700.

Trump knows history, unlike today's Democrats. If Republicans gain substantially in mid-terms, I estimate a 50% chance the Federal Reserve gets dissolved, although Trump may maintain a facade for publicity reasons. 90% of DU.com believe the Lisa Cook firing was racism because of their usual ignorant obsession with skin color and sex organs. Trump controls two Federal Reserve seats already and Cook's removal would make that three out of seven. Trump knows exactly what he's doing.

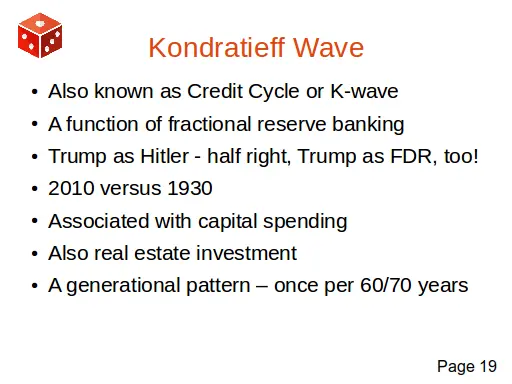

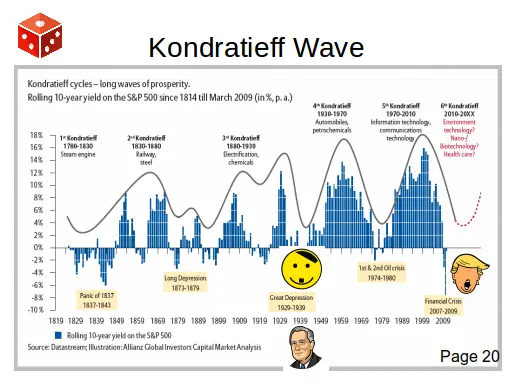

Refer to slides 18 and 19 from my DEFCON submission in 2017. Yes, I foresaw most of this because I know history and math. Unsustainable debt is unsustainable and eventually diverges from reality. Systemic failure. The Kondratieff wave is an approximate symbology mapped to reality, not an absolute law, but it must eventually resolve to Equilibrium.